2023 IN FIGURES: INCREASE IN REVENUE AND EARNINGS, PROFITABILITY STABLE

ORDER INTAKE

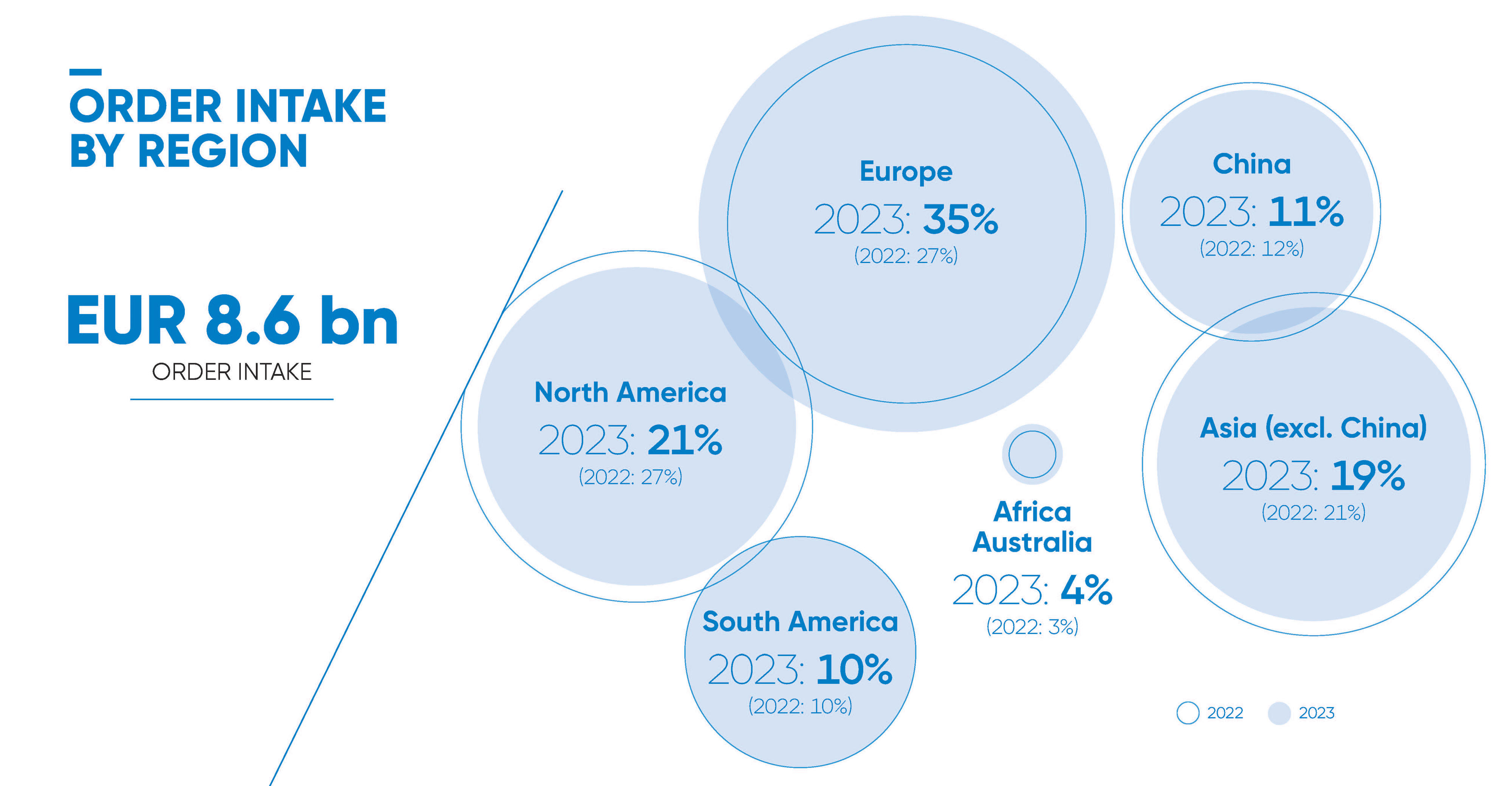

The ANDRITZ GROUP’s order intake amounted to 8,552 MEUR in 2023 and declined slightly after the record achieved in the previous year (-8% compared to 2022: 9,263 MEUR). The main reason for this was the downward trend in the Pulp & Paper business area, with the other three business areas showing strong performance and continuing to increase. Incoming orders for sustainable solutions and products developed particularly strongly.

Order intake in MEUR | 2023 | 2022 | +/- |

Pulp & Paper | 3,119.4 | 4,296.4 | -27.4% |

Metals | 2,124.5 | 2,008.6 | +5.8% |

Hydro | 2,020.9 | 1,720.5 | +17.5% |

Separation | 1,287.1 | 1,237.9 | +4.0% |

REVENUE

The Group’s revenue rose again in 2023 from the record set in 2022, reaching 8,660 MEUR, an increase of 15% year-on-year (2022: 7,543 MEUR). All four business areas recorded revenue growth compared to the previous year.

Revenue in MEUR | 2023 | 2022 | +/- |

Pulp & Paper | 4,096.3 | 3,513.8 | +16.6% |

Metals | 1,840.5 | 1,621.2 | +13.5% |

Hydro | 1,521.7 | 1,313.0 | +15.9% |

Separation | 1,201.5 | 1,094.9 | +9.7% |

EARNINGS

EBITA (the Group’s operating result) increased in line with revenue and recorded an increase of 14% to 742 MEUR (2022: 649 MEUR). An increase in the operating result was recorded in all four business areas. The EBITA margin remained unchanged at 8.6% (2022: 8.6%).

Earnings (EBITA) in MEUR | 2023 | 2022 | +/- |

Pulp & Paper | 421.7 | 378.9 | +11.3% |

Metals | 89.4 | 62.3 | +43.5% |

Hydro | 88.1 | 72.3 | +21.9% |

Separation | 142.7 | 135.0 | +5.7% |

ORDER BACKLOG

The ANDRITZ GROUP had an order backlog of 9,873 MEUR as of December 31, 2023. This was 1% lower than the figure for the previous year (December 31, 2022: 9,977 MEUR). The business areas Metals, Hydro and Separation recorded a significant increase on the previous year, whereas the order backlog of Pulp & Paper decreased.

NET WORTH POSITION AND CAPITAL STRUCTURE

Total assets amounted to 8,497 MEUR (December 31, 2022: 8,492 MEUR), the equity ratio increased to 25.4% (December 31, 2022: 21.6%).

Liquid funds stood at 1,787 MEUR as of December 31, 2023 (2,051 MEUR as of December 31, 2022). Net liquidity decreased to 913 MEUR (end of 2022: 983 MEUR).