THE ANDRITZ SHARE: A SUSTAINABLE INVESTMENT IN EVERY WAY

In 2023 international financial markets were dominated by the restrictive monetary policy of the central banks and the associated interest rate hikes to combat inflation.

Increasing geopolitical tensions, especially the war in Israel, had a negative impact on the global economy. The consequences of the Covid-19 pandemic are still being felt, albeit to a lesser extent than in 2022.

The ongoing war in Ukraine led to a significant rise in prices and high price volatility for energy, many commodities and industrial primary products in 2023. This was followed by a significant increase in inflation in many countries. In view of the persistently high inflation rate, the central banks of many industrialized countries raised their key interest rates from mid of 2021 significantly and at a historically rapid pace.

All of this led to subdued growth in Europe and moderate economic growth in the USA.

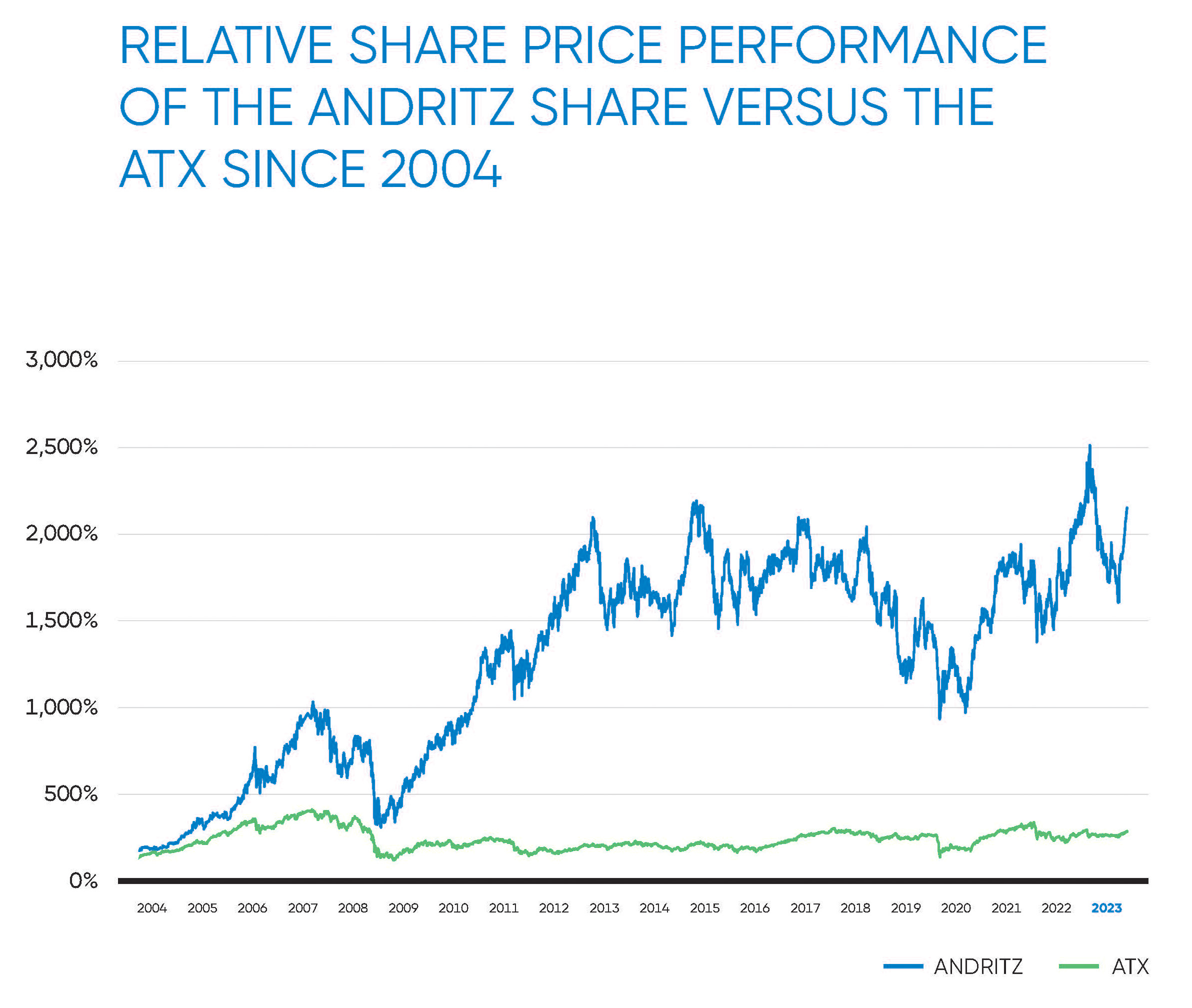

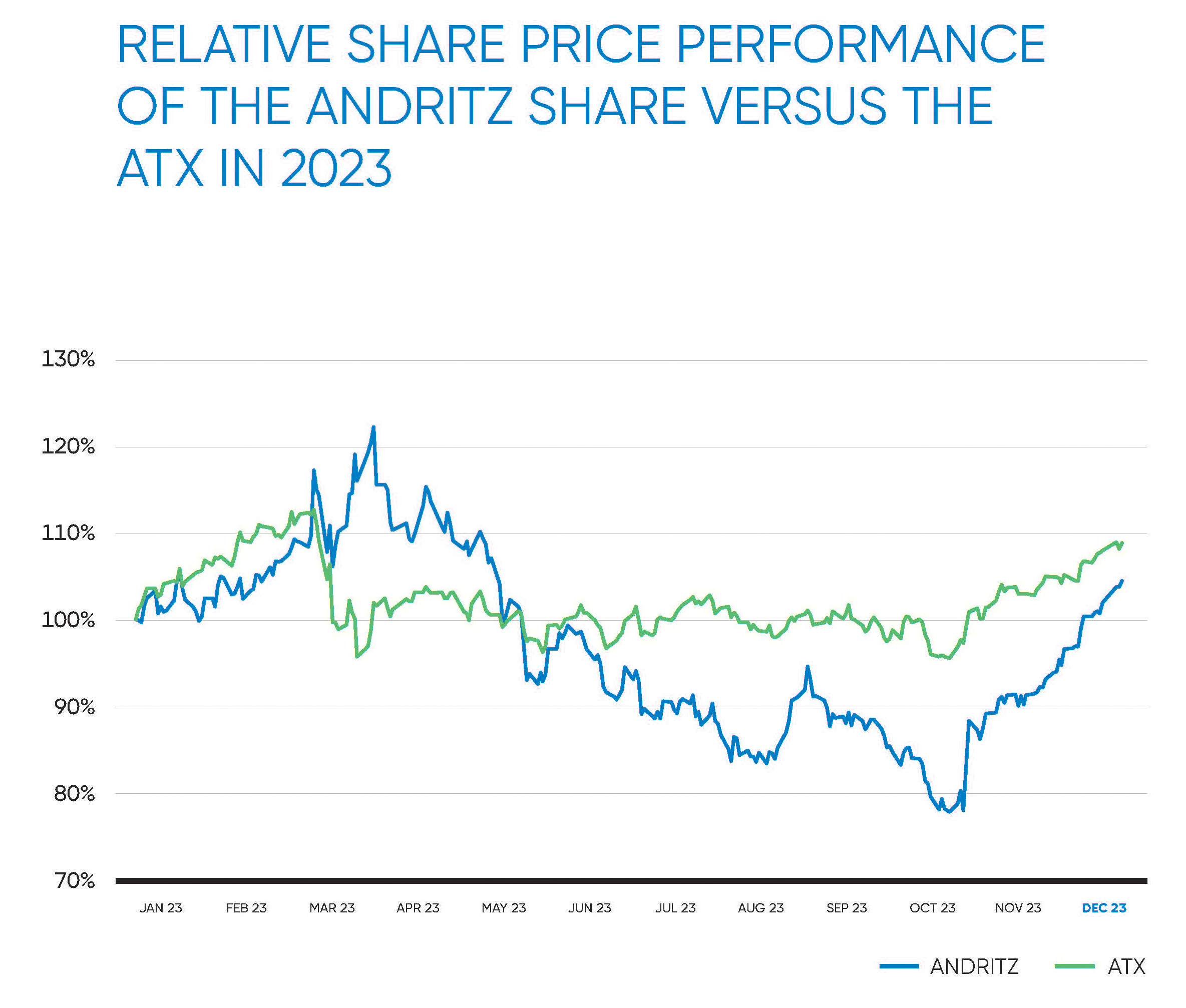

Against this backdrop, the ANDRITZ share price remained relatively stable, rising by 5.3% in 2023. The ATX, the leading share index on the Vienna Stock Exchange, increased by 9.9% in the same period. The highest closing price of the ANDRITZ share was 65.90 EUR (March 30, 2023), while the lowest closing price was 42.10 EUR (October 27, 2023).

LONG-TERM DIVIDEND POLICY

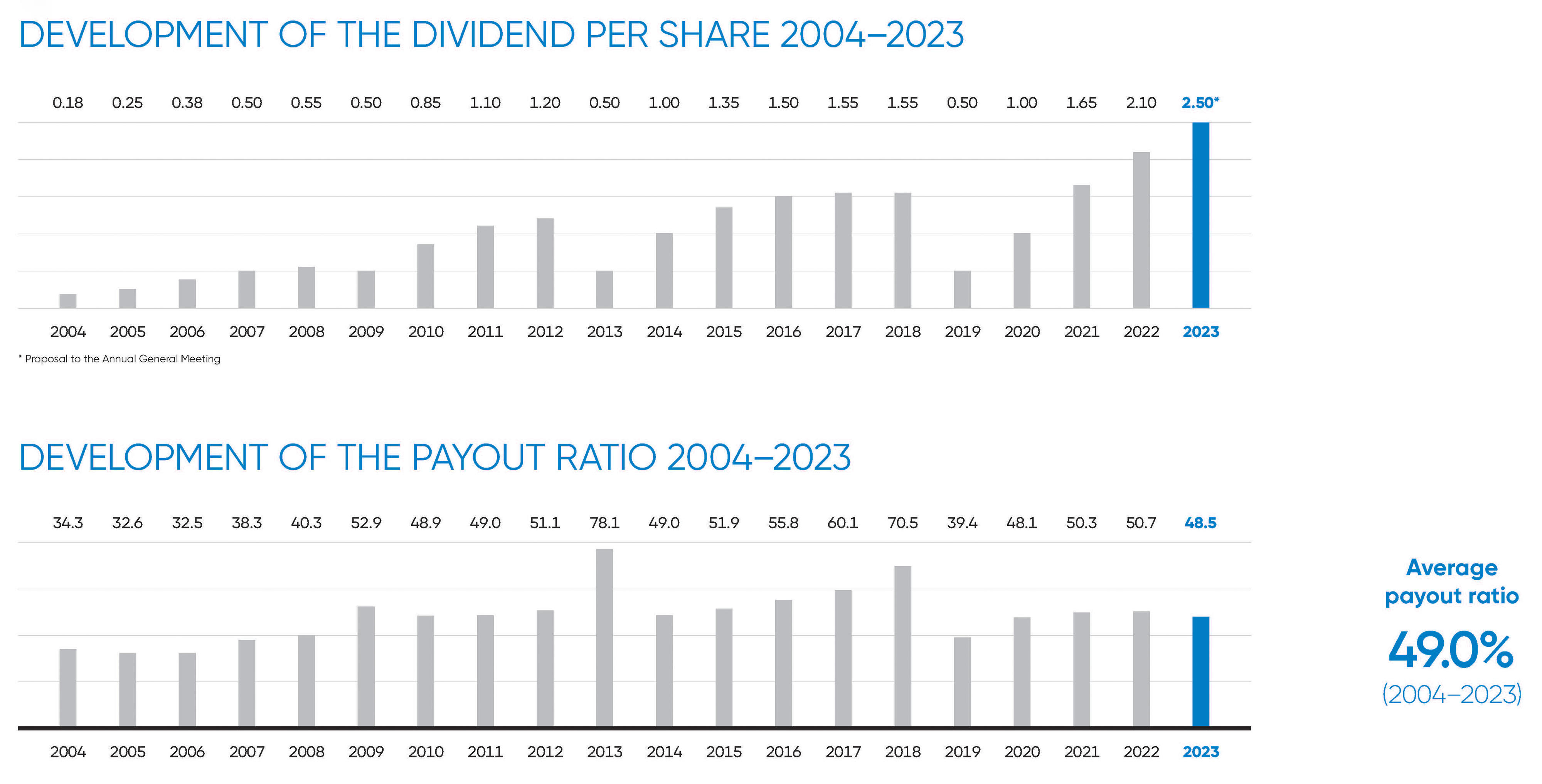

Our dividend policy is geared towards continuity. Accordingly, we aim to consistently pay dividends which grow along with the growth of ANDRITZ’s business year by year. We intend to distribute an average of 50-60% of net profit to shareholders in the long term, depending on our business requirements and any large-scale acquisitions.

STABLE AND WELL-BALANCED SHAREHOLDER STRUCTURE

ANDRITZ has a stable and well-balanced shareholder structure. The shareholder structure in the 2023 reporting year was as follows: around 31.5% of the share capital of ANDRITZ AG was held – directly and indirectly – by Custos Privatstiftung as well as Wolfgang Leitner, a member of the ANDRITZ AG Supervisory Board.

The company itself held around 4.5% of the shares. The free float amounted to around 64%, comprising national and international institutional investors and private (retail) investors. Most institutional investors come from the UK, Austria and Germany, while the bulk of retail shareholders are from Austria and Germany.

TRANSPARENT COMMUNICATION POLICY

Since ANDRITZ’s IPO in 2001, continuous and transparent communication with all shareholders – institutional and private – has been the foundation of our investor relations activities. In the 2023 financial year, we took part in numerous investor conferences. In addition, our Investor Relations team held frequent video and telephone conferences to inform investors and analysts about the company’s performance, its strategic and operational development, as well as the impact of economic developments, increased inflation, rising interest rates on individual markets and current ESG topics.

BROAD RESEARCH COVERAGE

In addition to overall economic and company-specific considerations, the recommendations and share price forecasts of analysts play an important role in investment decisions by shareholders.

The following international banks and investment houses publish analyses on ANDRITZ at regular intervals: Baader Bank, BNP Paribas Exane, Deutsche Bank, ERSTE Bank, HSBC Trinkaus, J.P. Morgan, Kepler Cheuvreux, Raiffeisen Bank International, UBS and Wiener Privatbank.

We provide up-to-date information on research coverage of ANDRITZ on the Investor Relations page of our website: andritz.com/research-coverage.

KEY FIGURES OF THE ANDRITZ SHARE

Unit | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | |

Earnings per share | EUR | 5.15 | 4.14 | 3.28 | 2.08 | 1.27 | 2.20 |

Dividend per share | EUR | 2.501 | 2.10 | 1.65 | 1.00 | 0.50 | 1.55 |

Payout ratio | % | 48.5 | 50.7 | 50.3 | 48.1 | 39.4 | 70.5 |

Price-earnings-ratio | - | 10.84 | 12.93 | 13.84 | 18.02 | 30.24 | 18.24 |

Equity attributable to shareholders per share | EUR | 21.99 | 18.69 | 15.86 | 12.64 | 12.05 | 13.02 |

Highest closing price | EUR | 65.90 | 54.55 | 50.85 | 38.82 | 45.06 | 53.50 |

Lowest closing price | EUR | 42.10 | 36.04 | 36.66 | 24.36 | 29.88 | 38.88 |

Closing price as of end of year | EUR | 56.40 | 53.55 | 45.38 | 37.48 | 38.40 | 40.12 |

Market capitalization | MEUR | 5,865.6 | 5,569.2 | 4,719.5 | 3,897.9 | 3,993.6 | 4,172.5 |

Performance | % | +5.3 | +18.0 | +21.1 | -2.4 | -4.3 | -14.8 |

ATX weighting | % | 7.8583 | 7.7744 | 5.3766 | 6.1243 | 5.6622 | 7.1045 |

Average trading volume2 | - | 237,344 | 288,913 | 313,879 | 628,900 | 511,221 | 354,084 |

Source: Vienna Stock Exchange

1) Proposal to the Annual General Meeting

2) Double counting - as published by the Vienna Stock Exchange

FINANCIAL CALENDAR 2023

The financial calendar with updates and information on the ANDRITZ share can be found on the Investor Relations page